The staff accountant job description predicts future finances based on current revenue. It looks at financial items like the cost of goods sold (COGS) and accounts receivable as a percentage of your total sales. This information about past sales data helps you predict future financial performance.

Explore related content by topic

- To calculate year-end accounts receivable, you don’t need to estimate your company’s ACP.

- The percentage-of-sales method is used to develop a budgeted set of financial statements.

- We’ll use her business as a reference point for applying the percent of sales method.

- It’s a quicker method because of its simplicity, so some businesses prefer it to other, more complex techniques.

- Take the starting A/R balance at the beginning of the year, plus the ending A/R balance at the end of each month.

Based on the financial outlook, businesses can make necessary changes to increase profitability. This technique is popular among advertising companies owing to its straightforwardness and the ability to directly link advertising expenditures with revenue or sales. When preparing a financial prediction using this method, businesses must prepare a plan and select the accounts the final projection must include. Some accounts that businesses may want to forecast include the accounts payable, inventory, accounts receivable, and COGS or cost of goods sold.

Why is the Percent of Sales Method Important?

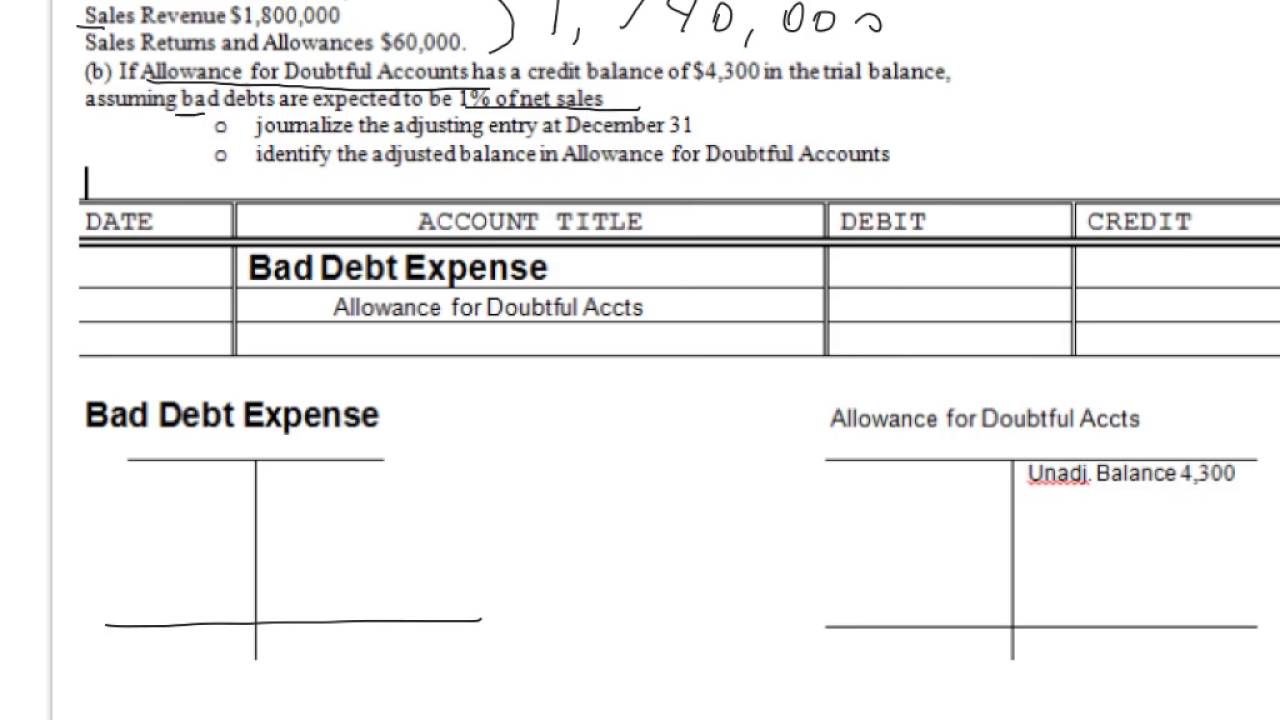

That is because the bad debt expense was recognized when the company recorded the estimated uncollectable amount in the period of respective sales recognition. So, bad debt expenses are only recorded when the company posts the estimates of uncollectable balances due from customers, but not when bad debts are actually written off. This approach fully satisfies the matching principle because revenues and related bad debt expenses are recorded in the same period. Keep in mind that the financial statements contain other accounts that do not vary with sales, such as notes payable, long-term debt, and common shares. The changes in these accounts are determined by which method the company chooses to finance its growth, debt, or equity.

Percentage of accounts receivable method – Accounting

Material prices or utility rates could have gone up uncontrollably during the year for example. Time for the electronic store’s owner to sit down with a cup of coffee and look at the relevant sales data. The business owner also needs to know how much they expect sales to increase to get the calculations going. That’s also the reason why it’s relatively easy to update with new historical sales data as it comes through. This forecasting helps the company allocate resources effectively and prepare for the expected financial demands of the coming year. The business projects that its sales will increase by 20% next year, resulting in projected sales of $1,200,000.

Explanation of percentage-of-sales approach

Estimating collection shortfalls is an important part of managing cash flow. Identify which financial elements to track along with your sales numbers. This number may seem small, but it’s crucial when you remember that she’s hoping for an increase of sales next month of $1,978. With a BDE of $1,100, she might be looking at merely an extra $878, which significantly impacts any new purchases she might be looking to make.

Just like weather forecasters sometimes get it wrong, the percentage of sales method also has limitations. Determine the balances of the line items and calculate their percentages relative to your sales. Organizations wanting to use a forecasting technique that is free of cost and can offer a better chance of success for future sales opt for this method. Besides the percentage of sales method formula, one must know its benefits and limitations. Businesses can determine how much (approximately) they can earn or lose in all accounts by taking the revenue percentage relevant to every account and applying it to the forecast number.

If you want a more accurate view of the company’s financial health, then the percentage-of-sales method can form part of a more detailed financial outlook statement. Let’s look at a practical example to help you understand how to apply the percentage of sales method. This method is helpful for contractors who need to make financial projections based on past performance. It’s especially useful for predicting the resources needed to handle upcoming projects and expenses. In this step, businesses hope to obtain positive percentages in all accounts. She decides she wants to put together a rough financial forecast for the future, so she opts to leverage the percent of sales method.

This is commonly done by percentage — if you know the percent amount your sales will increase, you can apply that to all line items as well, both assets and expenses. This includes things like accounts payable, accounts receivable, cash, cost of goods sold (COGS), fixed assets, and net income. To calculate the ACP, first need to estimate the company’s full year’s sales amount made to customers, but only those made on credit terms. For a budget or forecast, you could use the previous year’s credit sales numbers as a starting point and then factor in some growth to arrive at an estimate for the current or upcoming year forecast. The ability to come up with an estimate for year-end accounts receivable (A/R) helps companies assemble budgets or forecast financial statements. Accounts receivable represents the credit sales a company makes to its customers that have been billed but not yet paid by the customer.

The percentage of sales method is a financial forecasting tool that helps determine the impact of a forecasted change in sales volume on accounts that vary with a change in sales. By analyzing how a company’s financial results have changed over time, common size financial statements help investors spot trends that a standard financial statement may not uncover. Each historical expense is converted into a percentage of net sales, and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level. The approach can also be used to forecast some balance sheet items, such as accounts receivable, accounts payable, and inventory.

To demonstrate the application of the percentage-of-net-sales method, assume that you have gathered the following data, prior to any adjusting entries, for the Porter Company at the end of 2019. The effective activity of enterprises in a market economy largely depends on how reliably they foresee the long-term and short-term prospects of their development, that is, on forecasting. Bad debt expense represents the money that customers owe but are unlikely to pay.

This means that next year you should plan to have about the same amount of Fixed Assets to achieve the same level of Sales. If you forecast that the sales are going to grow by 10%, then you would need to plan to acquire more Fixed Assets, so their value would be 10% higher as well. Forecasting as a result of marketing research is the starting point for organizing production and selling exactly the products that the consumer needs. The main purpose of the forecast is to determine the trends of factors affecting the market conditions.